Global Market Trends for Halogenated Aromatic Hydrocarbons

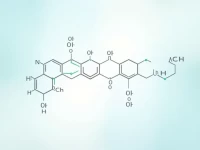

The code 2903699090 represents other halogenated derivatives of aromatic hydrocarbons, which have wide applications in the chemical industry. Both exports and imports under this code are tax-exempt, indicating its status as a special organic compound. Understanding this information is extremely important for industry practitioners.